DSCR Rental Loans

Easy funding for all of your rental properties

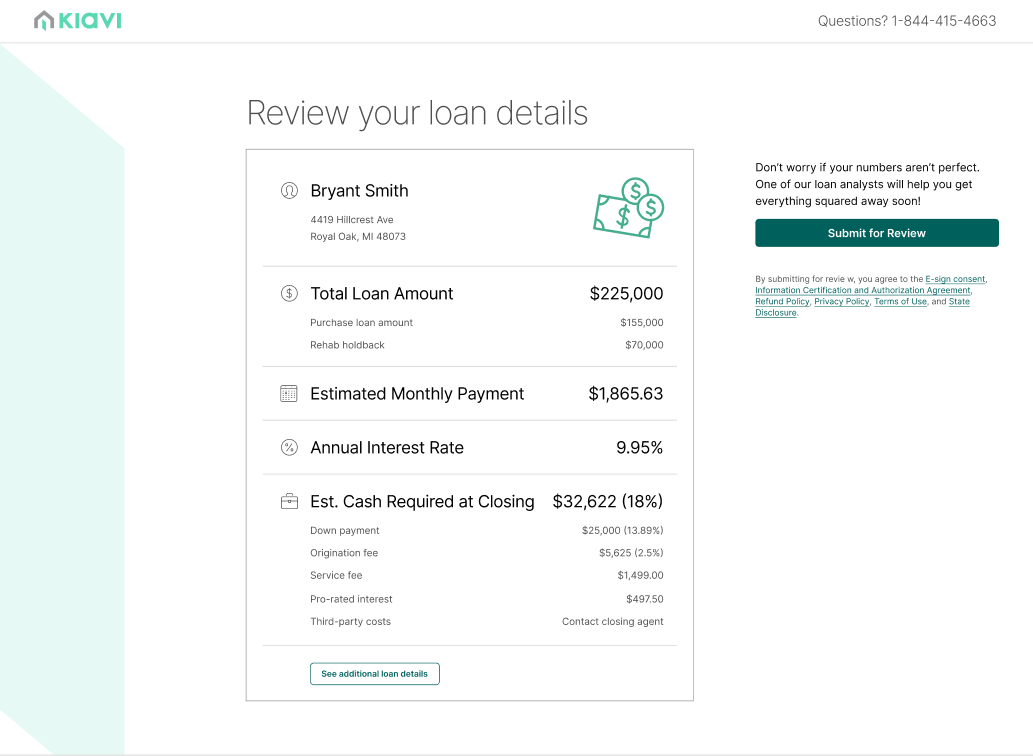

Want to finance a new purchase, refinance a property, or free up cash in your rental portfolio? Kiavi makes rental financing easy with our advanced online platform and flexible rental loan options.

Competitive Loan Rates

Maximize your returns with robust capital, high leverage, and competitive rates.

Fast and simple process

Forget searching for pay stubs and old W-2s. Our platform eliminates these time-consuming, manual tasks.

Flexibility and support

A variety of rental loan options and a dedicated team will help maximize your ROI and create a simplified experience.

Kiavi’s rental investment property loans

Purchase, Rate and Term, and Cash-out Refinance options are available for single-family rental (SFR), manufactured homes, PUDs, 2-4 units, and condos.

DSCR Rental Loan Rates + Terms

Adjustable-Rate Mortgages (ARM) designed for Real Estate Investors

Many real estate investors (REIs) are choosing Kiavi's adjustable-rate mortgage (ARM) options to enhance their monthly cash flow. An ARM offers a fixed interest rate for an initial period, after which the rate can fluctuate based on market conditions. This flexibility makes it an attractive choice for those looking to optimize their investment property portfolio.

5/1 ARM

Fixed rate for the first 5 years with fully amortizing and interest-only options

7/1 ARM

Fixed rate for the first 7 years with fully amortizing and interest-only options

Rental property financing made easy

Real estate investment loans don’t have to be difficult. At Kiavi, we realize you don’t have time for inconsistent human decisions and slow, paper-based processes you get from other lenders. You can even forget about searching for pay stubs and old W-2s, we don’t verify your income or employment.

Our tech-forward platform eliminates time-consuming tasks, putting everything at your fingertips. Quickly apply with ease, get pre-qualified, and track your loan’s status – the more you do, the easier it gets.

$23+ billion

of loans funded

85,000+

projects funded

45 states + DC

where we lend

What is a DSCR loan?

Kiavi’s long-term rental loans are also known as debt service coverage ratio (DSCR) loans or no-income mortgages. How does Kiavi's approach benefit you?

- No tax or personal income document needed

- Loans are based on rental property cash flow

- Flexible qualification guidelines

Kiavi gives me the confidence to not only access reliable capital to close more deals but provides a fast platform and industry support that helps my company scale.

Marcel Bonee, Southern CA-based real estate investor

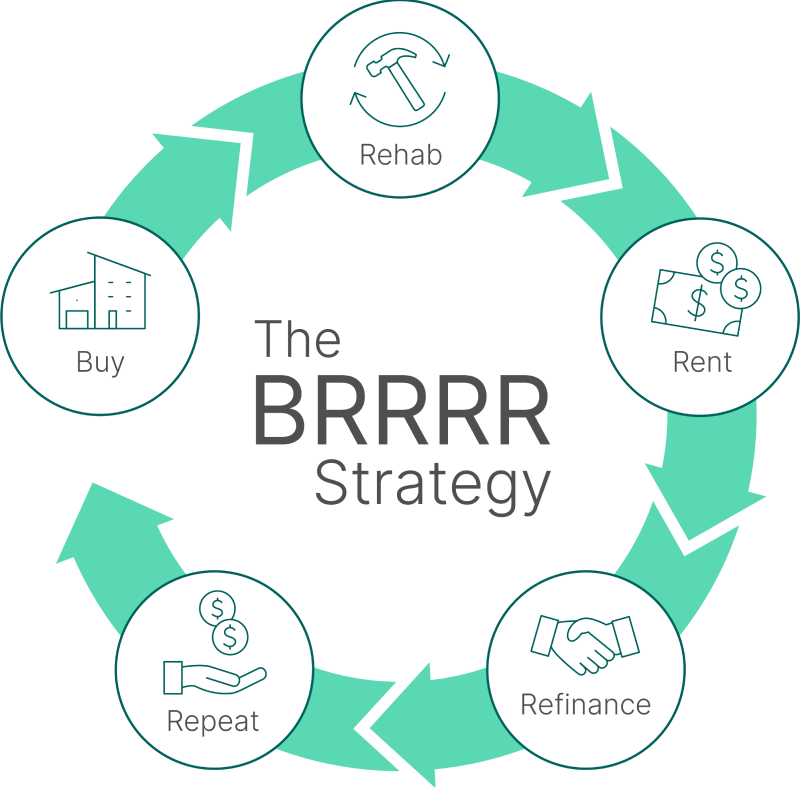

Rent and repeat: refinancing your BRRRR

Kiavi’s rental loan options are ideally suited to supporting your Buy, Rehab, Rent, Refinance, and Repeat (BRRR) strategy. Secure the property with a short-term real estate loan, such as a fix-and-flip or bridge loan, to cover both the purchase price and renovation costs. Once the rehab is complete, you can transition to a long-term rental loan with a lower interest rate. Additionally, opt for a cash-out refinance to fund your next property investment.

Want to learn more about BRRRR?

Check out Kiavi’s new eBook, Breaking Down BRRRR: Your guide to building a rental portfolio quickly and profitably using the BRRRR method. In it, we walk you through the financing process and illustrate the cash-on-cash return of this strategy compared to turnkey investments.

Expert guidance from an industry-leading real estate financing team

Whether adding your first rental property or accumulating multiple rentals into a large diversified portfolio, Kiavi can help guide you through which rental lending strategy best fits your needs to help you grow.

Our industry-leading team of real estate financing professionals is here to support you every step of the way. Plus, we love chatting about real estate! So, if you want to discuss financing options for your strategies, go over the numbers on a potential property or talk about your long-term goals, contact your Kiavi representative. We’re here to help and answer all of your questions.